Prime

Rai billionaire brothers now battle over Mumias

What you need to know:

- Jaswant Singh Rai, the chairman of Rai Group, has joined other bidders to try to wrest a lucrative leasing contract from his younger sibling --Sarbi Singh Rai.

- The rift in the Rai family became public last year when a case pitting the siblings against each other was filed in court, lifting the lid on the silent fight to control their late father’s multi-billion shilling estate.

- Jaswant on Tuesday tabled a new set of figures to back his claims to having been the highest bidder, challenging the 20-year lease handed to Uganda-based Sarrai Group, run by his brother.

Troubled Mumias Sugar Company has become the new battleground among the feuding billionaire Rai brothers after Jaswant Singh Rai, the chairman of Rai Group, joined other bidders to try to wrest a lucrative leasing contract from his younger sibling --Sarbi Singh Rai.

The rift in the Rai family became public last year when a case pitting the siblings against each other was filed in court, lifting the lid on the silent fight to control their late father’s multi-billion shilling estate.

Jaswant on Tuesday tabled a new set of figures to back his claims to having been the highest bidder, challenging the 20-year lease handed to Uganda-based Sarrai Group, run by his brother.

He made the application to join the case before Justice Wilfrida Okwany arguing that his company, West Kenya, placed the highest bid but receiver-manager Ponangipalli Rao allegedly awarded the deal to the lowest bidder, Sarrai Group.

Jaswant now wants the receiver to explain how he settled on his brother. He says his bid was for Sh36 billion yet Mr Rao settled on Sarrai with a bid of Sh6 billion.

Through Senior counsel Paul Muite, Jaswant said the receiver does not have the legal mandate or the professional expertise to make any findings on competition issues in Kenya or make any assessments on market share in any sector in Kenya.

“The figures and analysis produced by the 1st defendant in the said replying affidavit are imaginary and based on conjecture and hypothesis,” he said in an affidavit.

Further, Jaswant argues the rival has no track record of sugar production in Kenya whatsoever and that it is a company whose financial viability and technical ability has no record in Kenya. On the other hand, West Kenya is a well-established Kenyan company with a track record of sugar production in Kenya.

The West Kenya owner says the lease to Sarrai was actuated by other factors other than the best interest of the shareholders and creditors of the company.

He claims that the elimination of West Kenya at technical evaluation was not a matter within the receiver manager’s legal competence and accuses Mr Rao of usurping the powers of the Competition Authority of Kenya.

Mr Rao has, however, defended the leasing process, saying it was done per the law.

He said his role in the evaluation was not simply to check what figures had been inserted by the bidders as they were and not interrogate them in any way and that the submitted bid price was not the sole criteria for evaluation.

The KCB #ticker:KCB receiver said the Rai Group lost a bid to lease the ailing miller on account of his dominance in the sugar sector.

Mr Rao said that were Mr Rai to be awarded the lease, he would control 42 percent of the total sugarcane crushed in the country daily.

Mr Rao said this would have amounted to a dominant position in the sugar industry in view of the provisions of the Competition Act 2010.

A total of eight investors submitted bids to lease the troubled sugar factory. The revelation by West Kenya also put to question who the highest bidder was.

Tumaz & Tumaz, owned by Julius Mwale, had argued that it was the highest bidder with an offer of Sh28 billion followed by Kruman Finances, who wanted a 25-year lease with Sh19.7 billion. Other bidders were Pandhal Industries with Sh9.7 billion over 20 years and Kibos Sugar with Sh8.8 billion.

In another intrigue, some lawyers who alleged to be representing West Kenya told a media briefing that they were challenging the lease to Sarrai and that they want it to be given to Devki Group, associated with steel tycoon Narendra Raval.

The lawyers argued that Sarrai was not suited to run the plant given the bid amount that he placed during the process was lower when compared to other bidders.

Devki Group, which the lawyers claimed placed the highest bid of Sh61 billion as a lease offer, denied that figure arguing that the amount was way beyond what they had bid.

“What we placed as our offer for Mumias was less than Sh5 billion, we were not the highest bidders,” said Mr Raval in an interview with the Business Daily.

“I am no longer in the race for leasing Mumias,” he added.

Mr Raval withdrew from the tendering process before the exercise was completed, according to the receiver-manager.

The battle for Mumias is hinged on its vast estate and the control that whoever runs the plant will have in the sugar sector in the country.

The ailing firm has one of the largest nucleus estates at 4,000 hectares with the milling plant having a capacity of 8,000 per day, making it the largest sugar processor in Kenya.

The battle for Mumias has given Kenyans a further glimpse of the rivalry among the billionaire Rai brother.

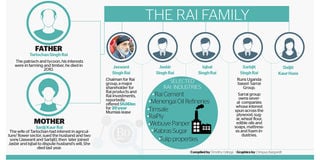

Sarbi is one of the five sons of Tarlochan Singh Rai who died in December 2010. He fell out with his brother over the distribution of the wealth left by the patriarch, forcing him to move out of the Rai Group whose chairman is Jaswant.

Their late mother Sarjij Kaur Rai had teamed up with her sons, Jasbir and Iqbal, objecting to the Will, saying the patriarch could have been coerced in crafting the document that distributed his assets among his eight beneficiaries. Jaswant is the executor of the Will.

The family has interests in cement production (Rai Cement), edible oils and soaps (Menengai Oil Refineries), sawmilling (Timsales, RaiPly and Webuye Panpaper), wheat farming, horticulture, sugar industry (West Kenya, which owns Kabras Sugar) and real estate (Tulip Properties).

The Rai family owns West Kenya, Sukari Industries and Olepito, which have taken over the market previously occupied by Mumias with their Kabras Sugar brand. At its peak, Mumias had more than 60 percent market share.

In 2020, Sugar Directorate data showed that the three firms owned by Mr Rai family controlled 45 percent of the total sales, which was a growth from the 41 percent market share they held in the corresponding period of 2019.

West Kenya had the lion’s share at 29 percent followed by Sukari Industries at 11 percent, with Olepito coming in at a distant third with two percent of the total 292,040 sales reported between January and June of 2020. Since 2020 the directorate has kept data on market control as a closely guarded secret.

Mumias owes Proparco Sh1.84 billion secured using the electricity generation plant, Ecobank Sh1.77 billion on the ethanol plant, and the Treasury Sh2.83 billion. Banks it owes more than Sh3 billion include KCB, NCBA #ticker:NCBA and Stanbic Bank #ticker:SBIC .

gandae@ke.nationmedia.com, skiplagat@ke.nationmedia.com

More From Business Daily

-

KRA reinstates ‘Nil return’ filing after system upgrade

-

Auditor-General warns Sh4bn NSSF assets in Nairobi risk grab

-

Why the right hiking boots can make or break a trek across Kenya’s trails

-

How tender interference cost Consolidated Bank’s ICT chief his job

-

Charles Mahinda takes over as CAK chair, Shaka Kariuki exits